Tax Number:

International students should get a tax number to manage financial procedures, such as opening a bank account, during their stay in Turkey. In particular, the ones who carry out Erasmus mobility in the scope of ICM (KA-107/KA-171) need to have a bank account (Euro) to receive their grant. It is easy to get a tax number online by following the steps below:

Application Link:

Steps:

- Go to https://dijital.gib.gov.tr/

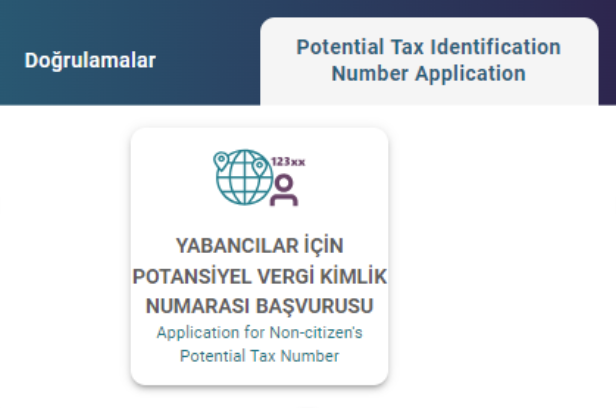

- Click on “Potential Tax Identification Number Application” button and then on “Application for Non-citizen’s Potential Tax Number (Yabancılar için Potensiyel Vergi Kimlik Numarası Başvurusu)”:

- Fill in the online form appears on the opening page.

- Complete the application and save/print the PDF file.

- Your tax number can be found in the PDF file.

If the system does not allow you to have a tax number online, then you must go to the office.

Address: Akşemsettin, Adnan Menderes Blv. No:56, 34080 Fatih/İstanbul

Direction: Click here

Addresses of all the tax offices in Istanbul can be found here: https://ivdb.gib.gov.tr/vergi-dairesi-mudurlukleri